Breaking Down Committed Credit Facilities for B2B SaaS

I recently joined my colleague Randall Lucas for a webinar on committed credit facilities. We covered what they are, how they work, and when they make sense for B2B SaaS companies. If you’re not familiar with the structure, this was designed with you in mind. It’s a nuanced topic, and we tried to keep it practical and easy to follow.

This post summarizes the key points we discussed so you can skim through and get a feel for what we covered. If anything stands out or seems relevant to your business, the full webinar is embedded below and walks through everything in more depth.

For context, I’m one of four partners at SaaS Capital. We’ve been lending to growing, private B2B SaaS companies since 2007. While many people know us for our annual metrics survey and research, this session highlights a different side of our work—helping founders and finance leaders understand funding structures that may or may not be the right fit.

How Committed Credit Facilities Work

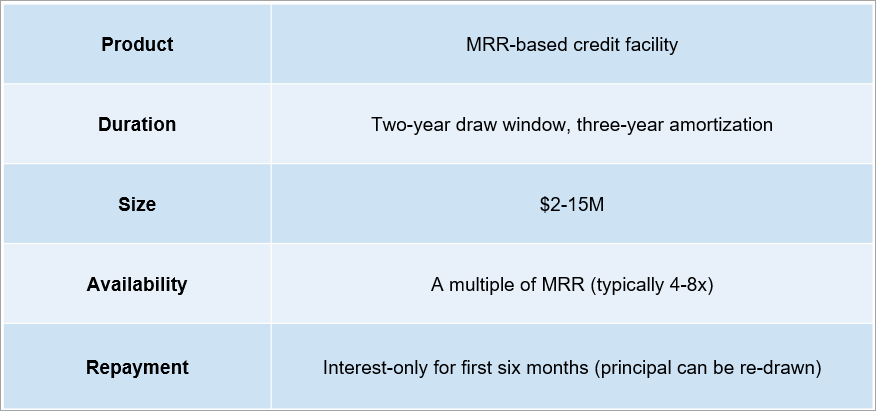

If you’re newer to committed credit facilities, here’s a quick breakdown of how we typically structure them for SaaS companies. It’s not a one-size-fits-all model, but there are some consistent features that make the approach flexible and scalable for recurring revenue businesses.

Our product: We typically provide companies with flexible, committed multi-draw credit facilities with availability based on a multiple of Monthly Recurring Revenue (MRR). In most cases, the draw window is two years with no requirement to draw after the initial draw. The availability multiple is usually somewhere between 4-8x MRR, and availability is intended to grow as MRR grows.

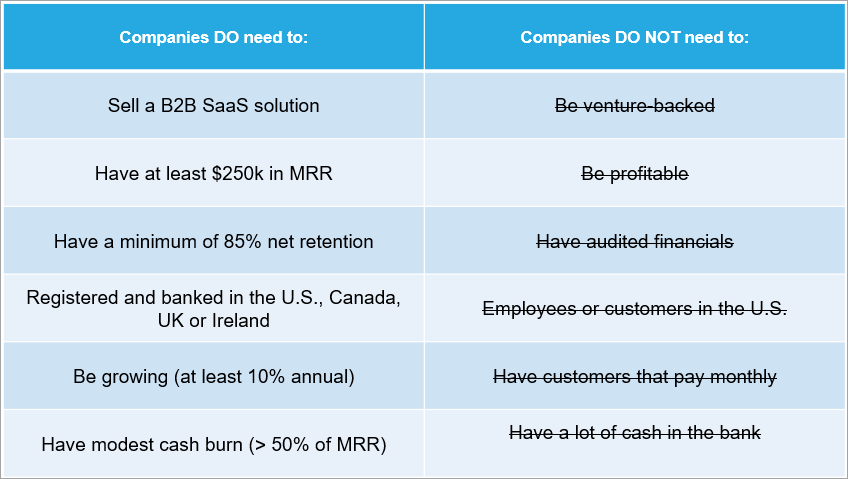

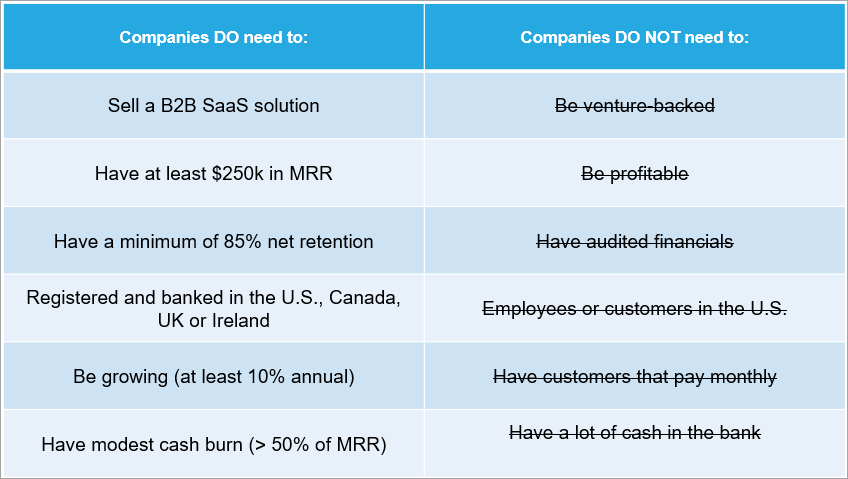

Criteria:

Mis-fits for us: Folks aren’t always a fit for our capital. Typical mis-fit reasons include having a short-term capital need (less than one year), having an aggressive cash burn plan (> 50% of MRR), having revenue that isn’t largely software subscription related (on-off transactions, consulting, hardware, storage) or being outside of our target geographies which include the US, Canada, UK and Ireland.

Structure:

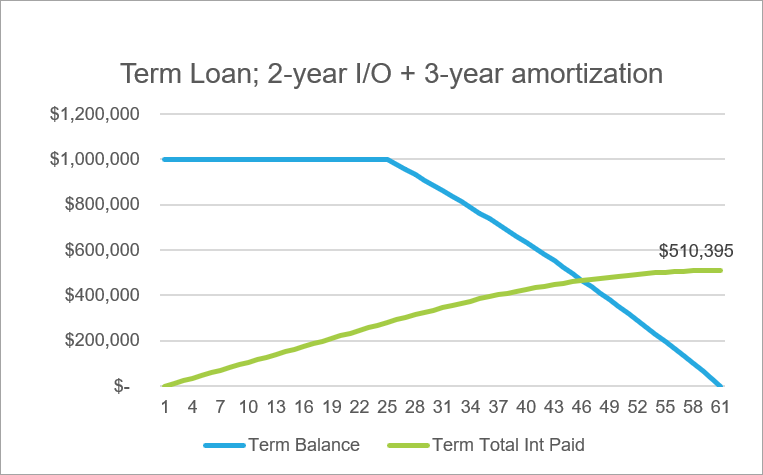

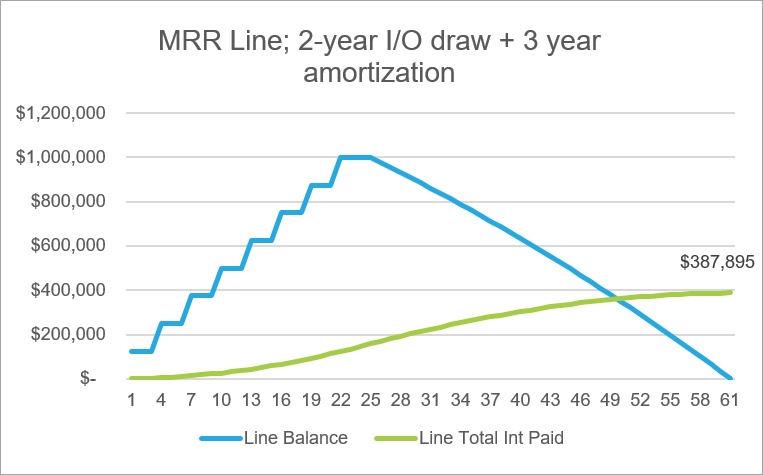

Line vs. Loan: Our line of credit structure can help companies save up to 24% on total interest costs compared to a term loan structure. For example, a $1 million facility at a 14.0% interest rate and a 2-year draw window / 3-year amortization saves $122k compared to a term loan with the same pricing and duration.

Mechanics: A typical process from “hello” to closing takes 5-8 weeks. Initial underwriting and negotiation takes 2-3 weeks and diligence usually takes 4-5 weeks. Once funded, borrowers are responsible for providing our team with a monthly reporting of financials and other metrics relevant to covenants. Payments are made monthly via ACH and draw requests are usually funded within 24-48 hours.

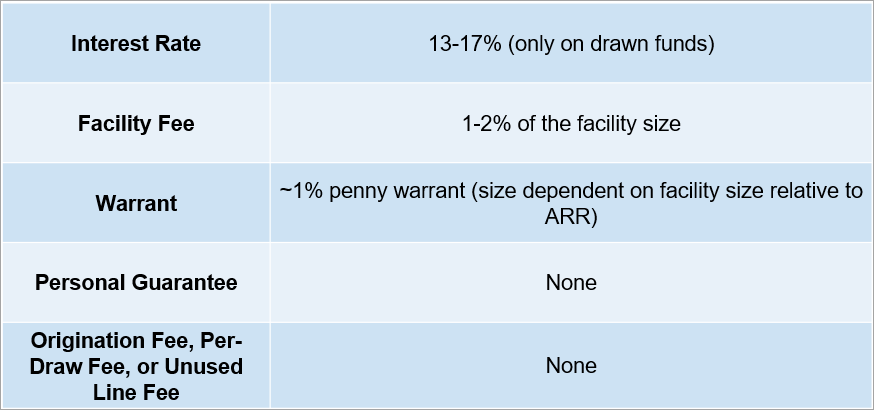

Pricing:

Security and Covenants: Like a traditional bank loan, our capital is senior secured, with collateral covering all company assets. As a senior lender, any existing debt will either be refinanced by our capital or subordinated. Our agreements typically include two covenants: one based on gross revenue retention and another on burn or EBIT loss. We work closely with management to tailor these covenants to align with the company’s growth plan while maintaining appropriate risk protection. We generally do not require balance sheet or liquidity covenants.

![]()